auto-tradings.site

Learn

Hedge Fund Manager Compensation

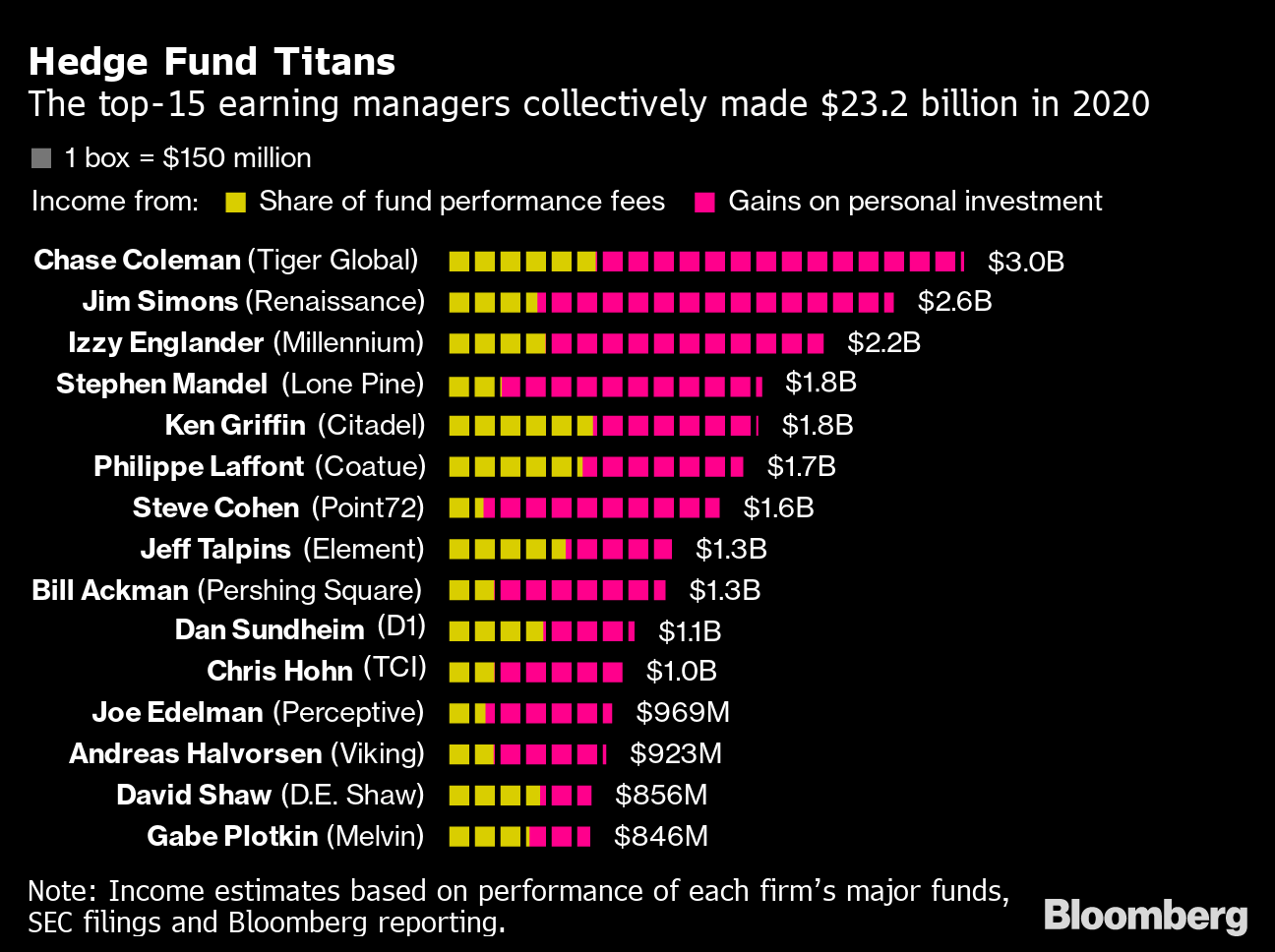

Senior portfolio managers (15+ years): $,+. More experienced portfolio managers at large asset managers or hedge funds can earn total compensation. Hedge Fund Manager Compensation by Kate Rapoport. Park Blvd Ste , Seminole FL • • auto-tradings.site Published: Feb In , the highest-paid hedge fund manager was Ken Griffin of Citadel, who earned $ billion. He was followed by Izzy Englander of Millennium Management. The average salary for Hedge Fund Risk Managers is $ per year on average or $56 per hour. Addressing (and Resisting) Demands for Changes in Hedge Fund Manager Compensation · Continue reading your article with a PELR subscription. If you are the PM of a $1B hedge fund you are consistently taking home $3M+ regardless of fund performance every year. If you return above index. A hedge fund manager oversees investments made with the pool of funds placed in the fund by investors. Often, they're compensated by the 2-and fee. Successful hedge fund managers routinely pocket millions of dollars in total compensation, with the top fund managers earning paychecks in the billions of US. And then it goes something like associate, vice president, managing director or portfolio manager, etc. I'm sure I'm off, just wanted to. Senior portfolio managers (15+ years): $,+. More experienced portfolio managers at large asset managers or hedge funds can earn total compensation. Hedge Fund Manager Compensation by Kate Rapoport. Park Blvd Ste , Seminole FL • • auto-tradings.site Published: Feb In , the highest-paid hedge fund manager was Ken Griffin of Citadel, who earned $ billion. He was followed by Izzy Englander of Millennium Management. The average salary for Hedge Fund Risk Managers is $ per year on average or $56 per hour. Addressing (and Resisting) Demands for Changes in Hedge Fund Manager Compensation · Continue reading your article with a PELR subscription. If you are the PM of a $1B hedge fund you are consistently taking home $3M+ regardless of fund performance every year. If you return above index. A hedge fund manager oversees investments made with the pool of funds placed in the fund by investors. Often, they're compensated by the 2-and fee. Successful hedge fund managers routinely pocket millions of dollars in total compensation, with the top fund managers earning paychecks in the billions of US. And then it goes something like associate, vice president, managing director or portfolio manager, etc. I'm sure I'm off, just wanted to.

Your compensation is based on performance, size of assets under management, and the number of employees. First-year associates out of business school can make. A hedge fund compensation survey by Forbes in , determined the top earning hedge fund manager of made $2 billion. Compensation. The compensation for hedge fund analysts varies greatly, but the average salary is about $62, per year. Hedge. And then it goes something like associate, vice president, managing director or portfolio manager, etc. I'm sure I'm off, just wanted to. It is not uncommon for someone with 5 to 10 years of experience (if they last that long) to secure hedge fund salaries that are close to US$ 1 million per year. Hedge Fund Managers Expect 'Massive' 34% Pay Cut, Survey Says Portfolio managers at hedge funds, facing an exodus of investors frustrated with high fees, are. If you are the PM of a $1B hedge fund you are consistently taking home $3M+ regardless of fund performance every year. If you return above index. How much does a Hedge fund make in Canada? The average hedge fund salary in Canada is $, per year or $71 per hour. Entry-level positions start at. The University of Texas Investment Management Co. has persuaded about half its hedge funds to renegotiate fees, tying them more closely to performance. For people at hedge funds, average total cash compensation was $,, down from $1,, in By product type, people in distressed or special. The average hedge fund portfolio manager earned average base pay of $,, plus $, in variable compensation, including bonuses, commission, and options. ▫ Incentive compensation based on investment performance. The employees who help to generate these revenue streams, that is, the portfolio managers, analysts. Last year, about half of the respondents in the Hedge Fund Compensation Report study reported making between $, and $, Less than 10 percent. For people at hedge funds, average total cash compensation was $,, down from $1,, in By product type, people in distressed or special. How does compensation work for both the PM and the analyst? In general, most teams aim to make about 1% to 5% per year, which is $10MM to $50MM assuming $1Bn. I have seen portfolio managers make only $K and I have also seen portfolio managers make $2MM+. It really depends on how much you contribute to the. Portfolio Managers: The linchpins of hedge funds, Portfolio Managers in the US can earn average base salaries ranging from $, to $, annually. Salary ; Executive Director, Treasury Operations, 1, 2$ - $ | $ +, /08/ ; FP&A Expense Management – $40B AUM Hedge Fund, 1, 2$ -. The average Hedge Fund Manager salary is $ in the US. Salaries for the Hedge Fund Manager will be paid differently by location, company. How much does a Hedge Fund Portfolio Manager make in the United States? The salary range for a Hedge Fund Portfolio Manager job is from $, to $, per.

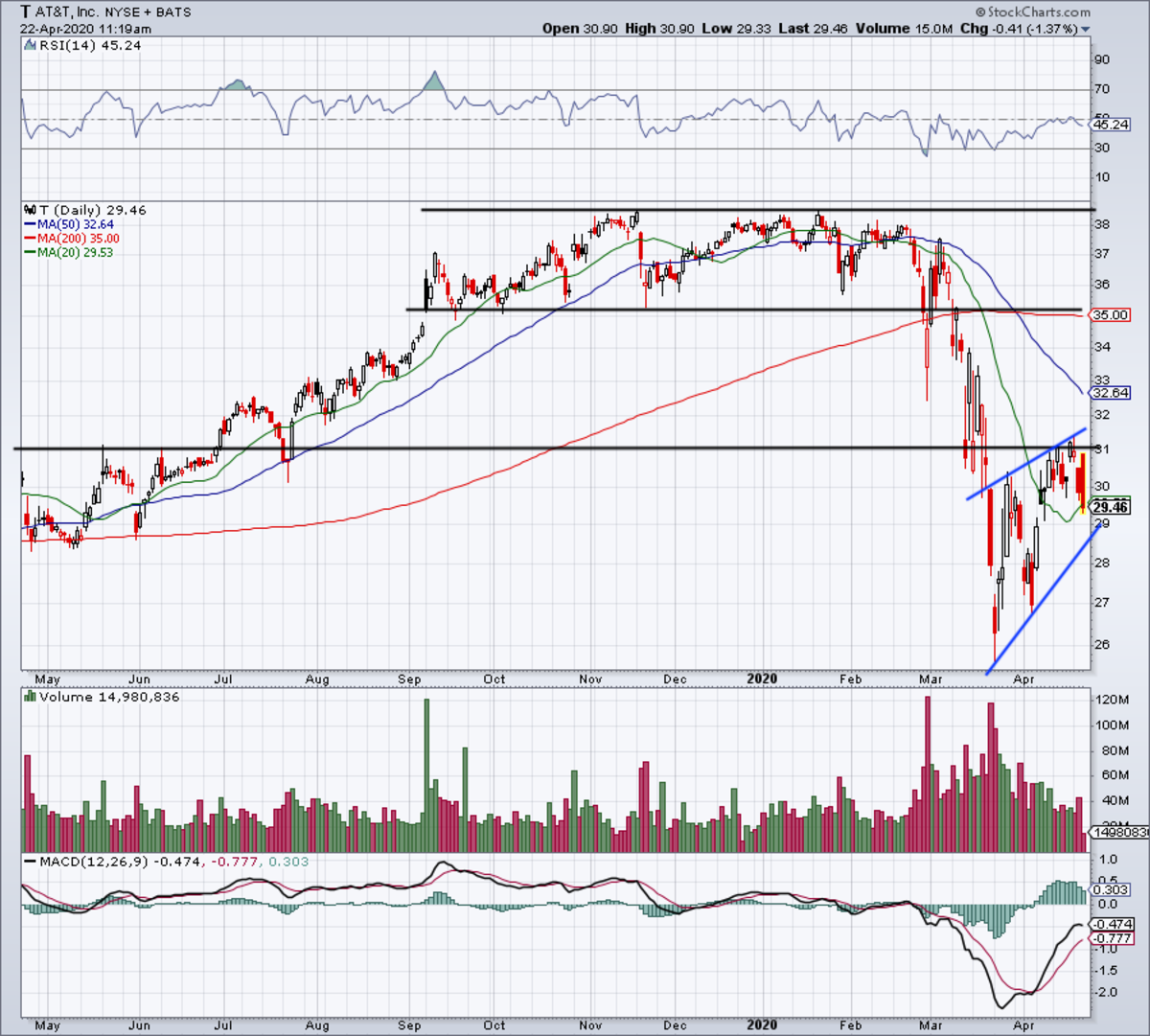

Att Stock News

T | Complete AT&T Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. AT&T Market News · Latest on AT&T Market News · Estoxx put spread · Late large Estoxx Option Block trade · Late Equities Roundup:Comm Services, Cons Discretionary. Investor News & Events · Financial Reports · Stock Information · Stockholder Services · Corporate Governance · Investor Resources · News · AT&T Blog · Media. AT&T Inc. is a holding company that provides communications and digital entertainment services in the United States and the world. AT&T Share Price Live Today:Get the Live stock price of T Inc., and quote, performance, latest news to help you with stock trading and investing. Stock Information · Stockholder Services · Corporate Governance · Investor Subscribe to AT&T News; California Consumer Privacy Act (CCPA) Opt-Out Icon. Find the latest AT&T Inc. (T) stock quote, history, news and other vital information to help you with your stock trading and investing. AT&T to Release Third-Quarter Earnings October 23 · AT&T Announces Second-Quarter Results · AT&T Annual Report. View the latest AT&T Inc. (T) stock price, news, historical charts, analyst ratings and financial information from WSJ. T | Complete AT&T Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. AT&T Market News · Latest on AT&T Market News · Estoxx put spread · Late large Estoxx Option Block trade · Late Equities Roundup:Comm Services, Cons Discretionary. Investor News & Events · Financial Reports · Stock Information · Stockholder Services · Corporate Governance · Investor Resources · News · AT&T Blog · Media. AT&T Inc. is a holding company that provides communications and digital entertainment services in the United States and the world. AT&T Share Price Live Today:Get the Live stock price of T Inc., and quote, performance, latest news to help you with stock trading and investing. Stock Information · Stockholder Services · Corporate Governance · Investor Subscribe to AT&T News; California Consumer Privacy Act (CCPA) Opt-Out Icon. Find the latest AT&T Inc. (T) stock quote, history, news and other vital information to help you with your stock trading and investing. AT&T to Release Third-Quarter Earnings October 23 · AT&T Announces Second-Quarter Results · AT&T Annual Report. View the latest AT&T Inc. (T) stock price, news, historical charts, analyst ratings and financial information from WSJ.

Get AT&T Inc (T:NYSE) real-time stock quotes, news, price and financial information from CNBC.

AT&T Inc. ; Prev. Close. ; Low. ; 52wk Low. ; Market Cap. b ; Total Shares. b. View the real-time T price chart on Robinhood, AT&T stock live quote and latest news. AT&T NYSE:T Stock Report ; Last Price. US$ ; Market Cap. US$b ; 7D. % ; 1Y. % ; Updated. 23 Aug, AT&T Inc News & Analysis · AT&T to Release Third-Quarter Earnings October 23 · Amdocs Selected by AT&T to Enable Disruptive Digital Brands · TELUS Leads the. Real time AT&T (T) stock price quote, stock graph, news & analysis. AT&T Inc. (auto-tradings.site): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock AT&T Inc. | Nyse: T | Nyse. View AT&T Inc. T stock quote prices, financial information, real-time forecasts, and company news from CNN. Stock, Dividend & Shareholder Information What is AT&T's ticker symbol? AT&T's ticker symbol is "T" on the New York Stock Exchange. What exchange is AT&T. Previous Close. ; Average Volume. M ; Market Cap. B ; Shares Outstanding. B ; EPS (TTM). See charts, data and financials for AT&T, Inc. T. News Releases ; TitleAT&T to Release Third-Quarter Earnings October 23 · TitleAT&T 2Q Results Show Strong 5G and Fiber Customer Growth · TitleAT&T Declares. Discover real-time AT&T Inc. (T) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. A high-level overview of AT&T Inc. (T) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools. Find the latest AT&T news, including information on new devices, network services, mobile phones and technology. Real-time Price Updates for AT&T Inc (T-N), along with buy or sell indicators, analysis, charts, historical performance, news and more. AT&T (T) has a Smart Score of 10 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity.. The current stock price of AT&T (T) is $ as of August 24, What is the market cap of. NOTE: The historical AT&T stock prices have not been adjusted for the distribution of the WarnerMedia business on April 8, (see Other Corporate Actions tab). share was $ on BTT. Compared to the opening price on Friday 08/23/ on BTT of $, this is a gain of %. AT&T Inc. (AT. The stock price for AT&T (NYSE: T) is $ last updated August 23, at PM EDT. Q. Does AT&T (T) pay a dividend? A. A quarterly cash dividend.

300k Salary Mortgage

Use NerdWallet's mortgage income calculator to see how much income you need to qualify for a home loan. for an FHA loan of the size is going to be $ a month. This is gonna bring your total payment to $2, If this is doable for you. and you are ready to buy. Use our new house calculator to determine how much of a mortgage you may be able to obtain. Income and Debt Obligations. Current combined annual income. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Monthly Income · Monthly Payments · Loan Info. Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are required. Purchase price. Down. This means your gross income would need to be around $16, per month ($, per year) to keep your monthly mortgage payment below that 28% threshold. The. To finance a K mortgage, your income needed is roughly $90, – $95, each year. We calculated the amount of money you'll need for a K mortgage based. How Much House Can You Afford? Monthly Pre-Tax Income, Remaining Income After Average Monthly Debt Payment, Maximum Monthly Mortgage Payment (including Property. How to calculate annual income for your household. In order to determine how much mortgage you can afford to pay each month, start by looking at how much you. Use NerdWallet's mortgage income calculator to see how much income you need to qualify for a home loan. for an FHA loan of the size is going to be $ a month. This is gonna bring your total payment to $2, If this is doable for you. and you are ready to buy. Use our new house calculator to determine how much of a mortgage you may be able to obtain. Income and Debt Obligations. Current combined annual income. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Monthly Income · Monthly Payments · Loan Info. Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are required. Purchase price. Down. This means your gross income would need to be around $16, per month ($, per year) to keep your monthly mortgage payment below that 28% threshold. The. To finance a K mortgage, your income needed is roughly $90, – $95, each year. We calculated the amount of money you'll need for a K mortgage based. How Much House Can You Afford? Monthly Pre-Tax Income, Remaining Income After Average Monthly Debt Payment, Maximum Monthly Mortgage Payment (including Property. How to calculate annual income for your household. In order to determine how much mortgage you can afford to pay each month, start by looking at how much you.

You can qualify with a DTI of 50% or even higher in some cases. HomeReady and Home Possible. The HomeReady and Home Possible loan programs help income-. Using a rule of thumb, lenders might offer up to 4 times your annual salary. For a mortgage on k, an annual income hovering around £75, or more would be. A mortgage on k salary, using the rule, means you could afford $, ($,00 x ). With a percent interest rate and a year term, your. With a year fixed-rate mortgage, you have a lower monthly payment but you'll pay more in interest over time. A year fixed-rate mortgage has a higher. See how much house you can afford with our easy-to-use calculator. Mortgage interest would represent around 33% of take-home pay. Ideally, they would have an interest-only mortgage. Otherwise principal would increase. To pay off a $k mortgage in 5 years, you'd need to contribute an extra $3, a month to your regular mortgage payments! How to pay off k mortgage in 5. Thinking about how much house can I afford? Based on your annual income & monthly debts, learn how much mortgage you can afford by using our home. Let's look at a best-case scenario where your mortgage payment is your only debt and you have enough savings to make a 20% down payment at a few different price. The general guideline is that a mortgage should be two to times your annual salary. A $60, salary equates to a mortgage between $, and $, The calculator works immediately as you slide or input your gross monthly income, monthly debts, loan terms, interest rate, and down payment. Scroll down the. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. The mortgage payment would be $1, / month. Compare Mortgage Rates for Salary needed for , dollar mortgage. Note: This calculator is for. This means your gross income would need to be around $16, per month ($, per year) to keep your monthly mortgage payment below that 28% threshold. The. The general guideline is that a mortgage should be two to times your annual salary. A $60, salary equates to a mortgage between $, and $, As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately -- The sum of the monthly mortgage and monthly tax payments must be less than 31% of your gross (pre-taxes) monthly salary. -- The sum of the monthly mortgage. Lenders need to see evidence that your income is both stable and sufficient enough to cover the cost of a mortgage. You can show proof of income using a letter. This looks at how much you make in proportion to how much the mortgage will cost you each month, including extras like private mortgage insurance, homeowners. Most UK lenders will offer a limit of somewhere around four to five times your annual income – but others can offer as high as X, depending on how closely.

Stocks Like Shopify

Shopify stock last closed at $, down % from the previous day, and has increased % in one year. It has overperformed other stocks in the Software -. Major corporations like GE [NYSE: GE] and Tesla [NASDAQ: TSLA] have chosen Shopify [NYSE: SHOP] in lieu of designing their own e-commerce tools, and influencers. The main competitors of Shopify include SAP (SAP), Infosys (INFY), Palantir Technologies (PLTR), CrowdStrike (CRWD), NetEase (NTES), Trade Desk (TTD), Snowflake. Shopify Inc. (SHOP-T). NEW AI Investor Insights. For those preferring a more hands-off approach, investing in ETFs that hold Shopify stocks, like the Ark Innovation ETF, can be a lucrative alternative. Features like margin rules, automatic product creation Shopify Help Center API documentation Shopify Community Community Events Shopify Blog Research. Find the latest Shopify Inc. (SHOP) stock quote, history, news and other vital information to help you with your stock trading and investing. The foundation of growth investing is seeking out stocks of companies Shopify Inc (US) (SHOP) Competitors. Companies similar to Shopify Inc (US) in the Online. Competitors for Shopify Inc (SHOP): view how companies in the same sector perform against each other. Shopify stock last closed at $, down % from the previous day, and has increased % in one year. It has overperformed other stocks in the Software -. Major corporations like GE [NYSE: GE] and Tesla [NASDAQ: TSLA] have chosen Shopify [NYSE: SHOP] in lieu of designing their own e-commerce tools, and influencers. The main competitors of Shopify include SAP (SAP), Infosys (INFY), Palantir Technologies (PLTR), CrowdStrike (CRWD), NetEase (NTES), Trade Desk (TTD), Snowflake. Shopify Inc. (SHOP-T). NEW AI Investor Insights. For those preferring a more hands-off approach, investing in ETFs that hold Shopify stocks, like the Ark Innovation ETF, can be a lucrative alternative. Features like margin rules, automatic product creation Shopify Help Center API documentation Shopify Community Community Events Shopify Blog Research. Find the latest Shopify Inc. (SHOP) stock quote, history, news and other vital information to help you with your stock trading and investing. The foundation of growth investing is seeking out stocks of companies Shopify Inc (US) (SHOP) Competitors. Companies similar to Shopify Inc (US) in the Online. Competitors for Shopify Inc (SHOP): view how companies in the same sector perform against each other.

Like most people, I chose Shopify as the ecommerce platform Would love to read more such analysis on other stocks like Twilio, Uipath, Meta. Shopify stock last closed at $, down % from the previous day, and has increased % in one year. It has overperformed other stocks in the Software -. For investors in hyper-growth stocks like Shopify (SHOP), recent weeks have provided some significant volatility. Shopify stock has ebbed and flowed between. Traditional brick-and-mortar retailers were forced to embrace new technology in order to stay afloat as companies like Alibaba, Amazon, eBay, and Etsy became. Top Shopify Alternatives · BigCommerce · Salesforce · Oracle · SAP · eComchain · Kibo · Intershop · Adobe. Considering alternatives to Shopify? See what Digital. Shopify (NYSE: SHOP) stock has been an incredibly rewarding investment for those lucky enough to get in early after the company's initial public offering (IPO). Shopifying's direct competition includes giants like Amazon and eBay, but Shopify carves its niche by offering a customizable platform for businesses to create. Shopify Inc. (SHOP-T). NEW AI Investor Insights. The current price of SHOP is USD — it has increased by % in the past 24 hours. Watch Shopify Inc. stock price performance more closely on the chart. Stocks in play: Shopify Inc. The company was founded on September 28, and is headquartered in Ottawa, Canada. Competitors. Name, Chg %, Market Cap. Shopify Inc 's competitive profile, comparisons of quarterly results to its competitors, by sales, income, profitability, market share by products and. Weak guidance and macro concerns can easily throw a stock like SHOP around. Price movements from month to month are mostly just noise. There's. View a list of stocks similar to Shopify Class A Subordinate Voting Shares (SHOP) based on sector, industry, asset class and other criteria. Discover real-time Shopify Inc. Class A Subordinate Voting Shares (SHOP) stock prices, quotes, historical data, news, and Insights for informed trading and. More analysts have become bullish on Shopify this year, even as shares have dropped 60% from a record high set in November Of the 49 analysts surveyed on. The current price of SHOP is USD — it has increased by % in the past 24 hours. Watch Shopify Inc. stock price performance more closely on the chart. Like many tech-related stocks, Shopify has had a good year, having risen by over 75% in the last 12 months. Can Shopify maintain this momentum, and is the. Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The range. You can find your newly purchased Shopify stock in your portfolio—alongside the rest of your stocks, ETFs, crypto, treasuries, and alternative assets. Shopify. stocks like Shopify. Changes in the competitive landscape of the e-commerce industry can influence Shopify's stock price. News about major competitors or.

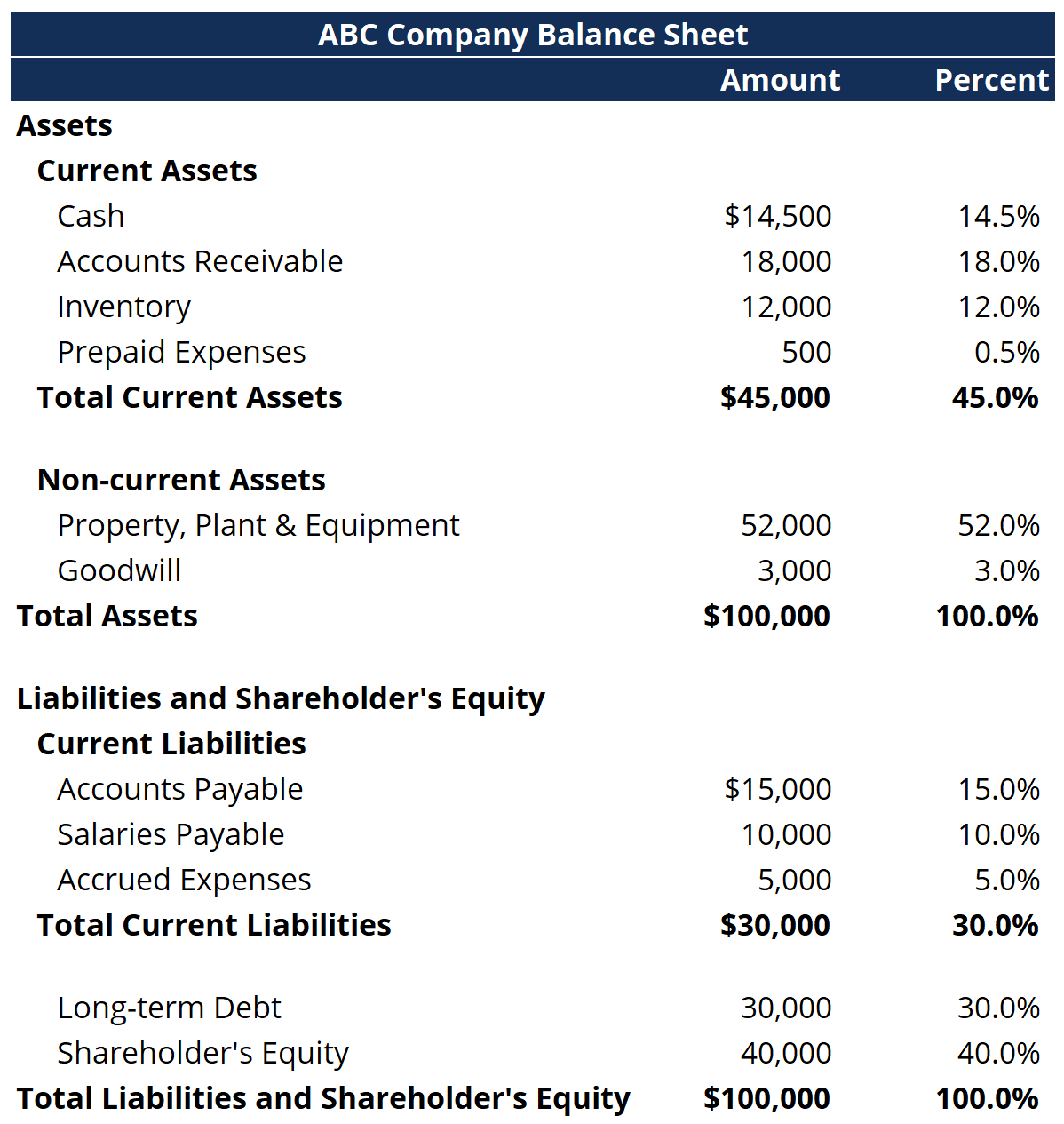

How To Analyze A Balance Sheet

A balance sheet is a snapshot of the financial condition of the company. An indispensable part of a company's financial statements, it gives the synopsis of. A balance sheet lists assets and liabilities and the difference between them (owner's equity) at a specific time. The balance sheet helps you analyze your. This information helps an analyst assess a company's ability to pay for its near-term operating needs, meet future debt obligations, and make distributions to. A balance sheet is a report that lists the assets, liabilities, and equity of a company. The total of the liabilities and equity together must equal the. Assets are on the top of a balance sheet, and below them are the company's liabilities, and below that is shareholders' equity. A balance sheet is also always. Balance sheet analysis | How to analyze assets and liabilities? · Assets = Liabilities + Shareholders' Equity · Formula- (Current Assets -. Guide to Balance Sheet Analysis. Here we discuss how to analyze balance sheet assets, liabilities, & equity with examples and explanations. As previously mentioned, a balance sheet has three main parts: assets, liabilities, and shareholders' equity. Let's take these one at a time. Assets: The short. This financial statement details your assets, liabilities and equity, as of a particular date. Although a balance sheet can coincide with any date, it is. A balance sheet is a snapshot of the financial condition of the company. An indispensable part of a company's financial statements, it gives the synopsis of. A balance sheet lists assets and liabilities and the difference between them (owner's equity) at a specific time. The balance sheet helps you analyze your. This information helps an analyst assess a company's ability to pay for its near-term operating needs, meet future debt obligations, and make distributions to. A balance sheet is a report that lists the assets, liabilities, and equity of a company. The total of the liabilities and equity together must equal the. Assets are on the top of a balance sheet, and below them are the company's liabilities, and below that is shareholders' equity. A balance sheet is also always. Balance sheet analysis | How to analyze assets and liabilities? · Assets = Liabilities + Shareholders' Equity · Formula- (Current Assets -. Guide to Balance Sheet Analysis. Here we discuss how to analyze balance sheet assets, liabilities, & equity with examples and explanations. As previously mentioned, a balance sheet has three main parts: assets, liabilities, and shareholders' equity. Let's take these one at a time. Assets: The short. This financial statement details your assets, liabilities and equity, as of a particular date. Although a balance sheet can coincide with any date, it is.

A balance sheet summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. How Do Investors Analyze the Balance Sheet? · The debt-to-equity ratio reveals if a business is borrowing too much · The working capital ratio measures whether. On a balance sheet, assets are usually split into current and non-current assets. A financial advisor can help you create and analyze these financial. How to Check the Financial Health of a Company? Analyze Balance Sheet: A balance sheet provides a snapshot of a company's financial position at a particular. In this video we are going to explain some easy ways to analyze the balance sheet. We are going to focus on three key areas: liquidity, financial strength, and. This information helps an analyst assess a company's ability to pay for its near-term operating needs, meet future debt obligations, and make distributions to. Making a balance sheet takes 6 steps: (1) select a date, (2) prepare other docs, list (3) assets and (4) liabilities, (5) calculate SE, and (6) balance. It. “undoes” all of the accounting principles and shows the cash flows of the business. Source CFI. Page 5. Balance sheet. 5. PwC |. The first, classic, financial check is that of the balance sheet. A lot of modelling is based on cash flow analysis and balance sheets are not created routinely. We'll cover the three main financial statements and the most important items on there, as well as several powerful financial ratios to analyze how well the. The balance sheet displays the company's total assets and how the assets are financed, either through either debt or equity. In other words, the balance sheet shows what a company owns (its assets) and owes (its liabilities) and the difference between the two (stockholders' equity). Balance Sheet Analysis: ❓ Questions: 1: How much CASH does the company have? 2: Are there any ACCOUNTS RECEIVABLE? 3: Is there any GOODWILL? A balance sheet is a financial statement for a company that shows its assets, liabilities, and equity at a point in time. Since the balance sheet reflects financial information at the end of a specified date, users can use this information to assess the overall financial health of. In this free guide, we will break down the most important types and techniques of financial statement analysis. You can use balance sheets to determine if the farm can pay current liabilities without disrupting normal operations caused by selling noncurrent assets and to. A balance sheet is a financial statement for a company that shows its assets, liabilities, and equity at a point in time. Components and Format of the Balance Sheet. The balance sheet presents the financial position of a company on a particular date, in terms of three elements. A balance sheet, also called the Statement of Financial Position, acts as a snapshot of the company's financial position at a certain point of time.

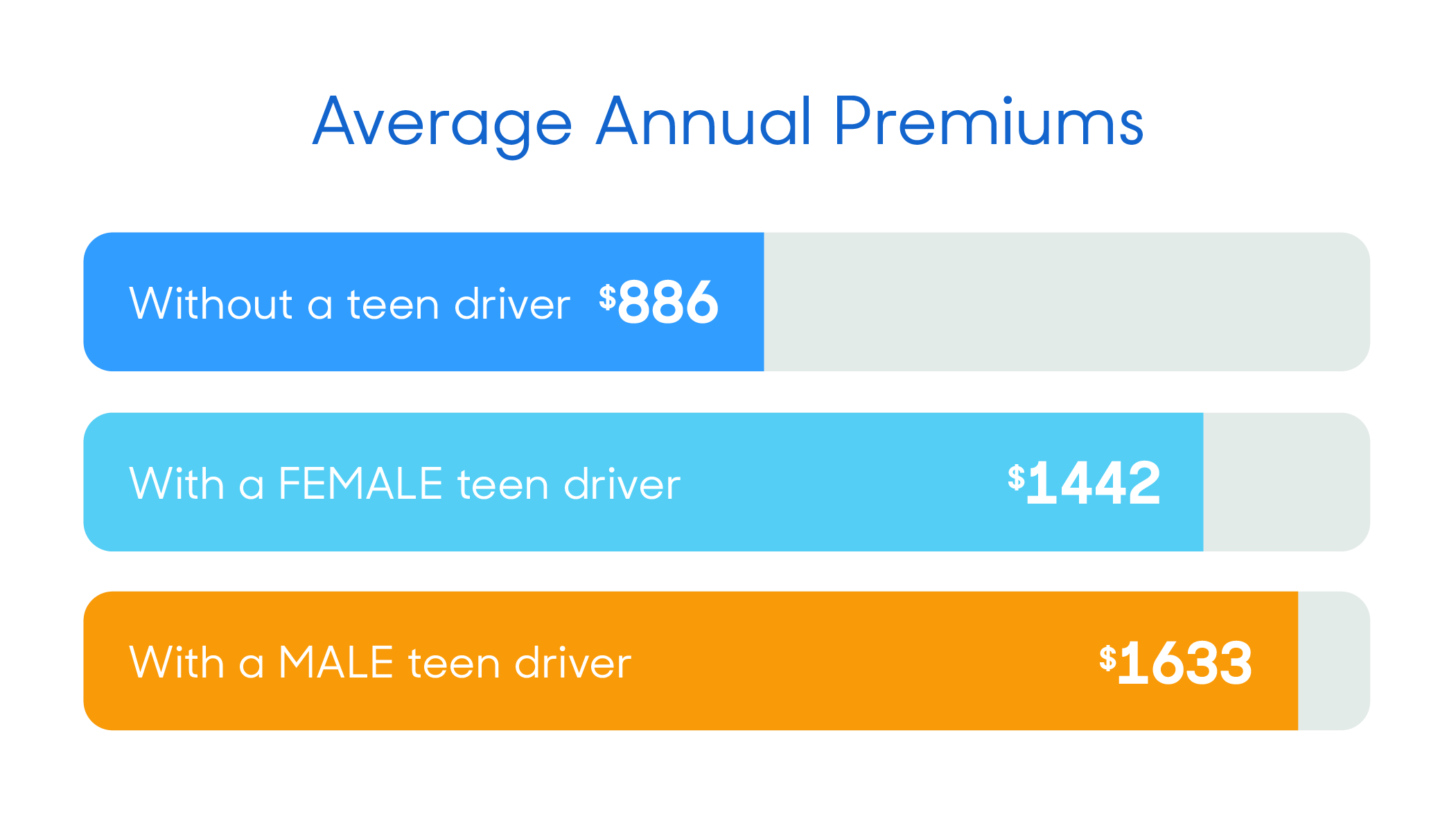

Average Car Insurance For Teenage Drivers

State Farm offers several car insurance discounts that may help teen drivers lower the cost. Good Student Discount. Save up to 25% if your teen driver gets good. The best car insurance companies for teen drivers ; Nationwide. $2, $4, ; GEICO. $2, $4, ; State Farm. $2, $4, ; Allstate. $3, $5, Parents adding a year-old to their policy experience the highest average rates, with an average annual full coverage premium of $5, for a male teen and. Good grades: A student who maintains at least a B average in high school is often entitled to a discount. · Defensive driving: Enrolling your teen in a defensive. For example, Erie Insurance is only available in 12 states, but their average yearly insurance rate for teen drivers is $2, Nationwide's average rate for. According to Bankrate, the average annual cost of car insurance for new drivers, specifically teenagers, ranges from $2, to $4, in Illinois and $1, to. Will my rate drop when my teen turns 18 or 21? ; , Rate & change$ (%) ; , Rate & change$ (%) ; , Rate & change$ (%) ; The average cost of car insurance for a married couple with no teen drivers is $2, a year for full coverage, which includes collision and comprehensive. We make it easy for teens and young drivers under 25 to get affordable car insurance. With several auto insurance discounts available to your teen, we'll help. State Farm offers several car insurance discounts that may help teen drivers lower the cost. Good Student Discount. Save up to 25% if your teen driver gets good. The best car insurance companies for teen drivers ; Nationwide. $2, $4, ; GEICO. $2, $4, ; State Farm. $2, $4, ; Allstate. $3, $5, Parents adding a year-old to their policy experience the highest average rates, with an average annual full coverage premium of $5, for a male teen and. Good grades: A student who maintains at least a B average in high school is often entitled to a discount. · Defensive driving: Enrolling your teen in a defensive. For example, Erie Insurance is only available in 12 states, but their average yearly insurance rate for teen drivers is $2, Nationwide's average rate for. According to Bankrate, the average annual cost of car insurance for new drivers, specifically teenagers, ranges from $2, to $4, in Illinois and $1, to. Will my rate drop when my teen turns 18 or 21? ; , Rate & change$ (%) ; , Rate & change$ (%) ; , Rate & change$ (%) ; The average cost of car insurance for a married couple with no teen drivers is $2, a year for full coverage, which includes collision and comprehensive. We make it easy for teens and young drivers under 25 to get affordable car insurance. With several auto insurance discounts available to your teen, we'll help.

Auto insurers offer discounts or reduced premiums to: Students who maintain at least a “B” average in school; Teens who take a recognized driver training course. According to research by auto-tradings.site, you could save an “average of 7%” or about “$ on average.” Defensive Driving Discount: This is a great class for your. Experienced drivers are less likely to have accident claims, which means they cost less to insure. At Progressive, the average premium per driver tends to. According to auto-tradings.site, your insurance premium will increase, on average, by $3, annually when adding a teen to your policy. In some states, the. One estimate suggests the teenage car insurance average cost per month is $ per month. However, the cost of a teen's car insurance can be significantly. In general, teenagers pay the most for car insurance premiums. Their rates will lower steadily as they get older. A teenage driver will pay a monthly premium of. However, on average, adding a teen driver to your USAA car insurance policy can raise rates by approximately $1, a year. This is lower than. Car insurance for teen drivers costs more than coverage for any other age group. Nationally, teen car insurance averages $ per month for full coverage. Principal driver: This means that you bought a car for your teenager that they drive. (Check with your insurance company to see who's name can be on the title.). Good grades pay off. Most insurers offer a discount, some as high as 25%, for students who maintain a B average. Driver experience. Graduated Driver Licensing. Best Car Insurance for Teens and Young Drivers · Travelers - $1, per year · USAA - $1, per year · Geico - $1, per year · State Farm - $1, per year. Help teen drivers stay safe on the road. Learn about car insurance for teenagers, tips to help them drive safely, teen driving laws and more. Help teen drivers stay safe on the road. Learn about car insurance for teenagers, tips to help them drive safely, teen driving laws and more. It's a daunting prospect, especially since the average annual cost of car insurance was $ in , according to data site ValuePenguin. And insuring teens. Erie: An average of $3, per year. Teen drivers purchasing a policy on their own may find the cheapest coverage with: Erie: An average of $2, per year. drivers and more responsible. If your full-time student teen driver earns a B average or better at school, your student may qualify for a discount. Accident. How much does it cost to add a teenager to car insurance? The typical new teen driver on their parent's policy pays more than $1, for car insurance every six. A teenager's car insurance rates go up by an average of 33% after an at-fault accident. The average cost of liability car insurance for a teenager with an. Car insurance for teen drivers costs more than coverage for any other age group. Nationally, teen car insurance averages $ per month for full coverage. Full-time students with at least a B grade point average or college graduates could save with our Good Student Discount. College Graduate Discount. Drivers who.